Peculiarities of proving the reality of business transactions, the problem of reality and fictitiousness of business transactions on the border of industry regulation, fiscal security of business entities in the conditions of war and post-war reconstruction – these and other issues were considered by the participants of the round table "Conducting business transactions: border between reality and fictitiousness".

Peculiarities of proving the reality of business transactions, the problem of reality and fictitiousness of business transactions on the border of industry regulation, fiscal security of business entities in the conditions of war and post-war reconstruction – these and other issues were considered by the participants of the round table "Conducting business transactions: border between reality and fictitiousness".

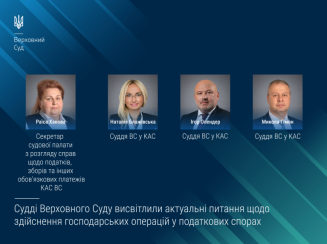

In her welcome speech, the secretary of the judicial chamber dealing with taxes, fees and other mandatory payments of the Administrative Court of Cassation as part of the Supreme Court, Raisa Khanova, thanked the ZSU for the opportunity to work and discuss such important issues among lawyers.

She informed that during the period of the court's work, 123,260 cases and materials were under consideration by the court chamber, of which more than 82,000 were received from the state tax service authorities, and more than 40,000 from taxpayers. More than 120,000 cases were considered. This year alone, 12,452 cases and materials were received. According to the results of their review, 3,936 (or 24%) of the total number of considered materials of cassation appeals were returned. Regarding 7,110 (43%) cases, the opening of proceedings was refused, and regarding 628 (4%) cassation appeals, proceedings were opened. The speaker noted that such a significant percentage of refusals is connected with the fact that tax authorities appeal decisions in minor cases.

Raisa Khanova also gave a report "Criteria for evaluating the reality of business transactions during the resolution of tax disputes." She noted that the basis of the formation of accounting and tax reporting data is an economic transaction. It is the foundation on which all further data is based.

The reality of the economic operation is a guarantee of sustainable economic development of the state. Conversely, any operation disguised as a real operation undermines the country's economy and, as a result, leads to the destruction of social relations.

The judge said that the bodies of the state tax service, in carrying out their functions, determined the criteria for assessing the reality of economic transactions, which are to be established when signs of fictitious entrepreneurship are detected. The application of criteria in the resolution of tax disputes is based on taking into account the principles of tax law, in particular the principles.

The speaker noted that a large volume of Supreme Court practice is focused on the analysis of the key principle of "predominance of essence over form" (cases No. 911/1111/15, No. 915/878/16, No. 440/1082/19, No. 826/5608/17) . The application of this principle makes it possible, on the basis of the priority of economic interpretation, to rely primarily on the essence, a reliable and objective representation of economic transactions on the domestic and foreign markets in specific economic conditions. This principle should be all-encompassing for financial law during the qualification of the performed economic transactions, primarily according to their economic nature and the actual behavior of the participants in the relationship.

Another important criterion concerns the existence of a business purpose (reasonable economic reason), which is used in tax disputes regarding the "unreality of transactions". According to Raisa Khanova, the definition of a "business" goal always contains an element of subjectivity.

At the same time, as the judge noted, there are no predetermined criteria for assessing the business purpose or the only correct way of proving it, because during the court process all the circumstances of the case will be studied, which will have an individual character, and therefore the taxpayer must be ready for the fact that in the court in the process of proving the existence of the intention to obtain an economic effect from a specific operation of his economic activity.

In addition, a detailed study of the specifics of the counterparty's activities, assessment of primary documents, plays an important role in assessing the reality of business transactions in court practice.

In the end, the speaker noted that when establishing the boundary between fictitiousness and reality of economic transactions, the key issue for the court is to ensure the unity and stability of the dispute resolution practice. Of particular value is the fact that although it is not considered entirely possible to form a unified approach for all categories of cases, each dispute is subject to individual assessment and its resolution is determined by specific factual circumstances.

In the national legal field, it is necessary to focus on payers who conduct legitimate economic activities, protecting them in courts, providing them with the opportunity to function in the extremely difficult conditions of war and the post-war state. Legislation must guarantee their safety and protection.

According to Nataliya Blazhivska, the organizer and moderator of the event, the judge of the Supreme Court in the Cassation Administrative Court, the topic of this discussion is absolutely important for all business entities. It is important that a bona fide taxpayer should be able to prove the reality of his economic transactions on the basis of proper and admissible evidence. Therefore, the topics of the reports were carefully chosen in order to reveal and discuss the most important and most common problematic issues that arise in the course of proving the reality of economic transactions on the example of the legal positions of the Supreme Court of the Supreme Court and the Grand Chamber of the Supreme Court.

Judge of the Supreme Court in the Cassation Administrative Court Ihor Olender spoke about the application of the concept of guilt in tax relations. He informed that from January 1, 2021, taking into account the changes made by the Law of Ukraine dated January 16, 2020 No. 466-IX "On Amendments to the Tax Code of Ukraine regarding the improvement of tax administration, elimination of technical and logical inconsistencies in tax legislation", the updated the concept of fault in tax law. This category has not yet received comprehensive coverage in the practice of the Supreme Court, but it is extremely relevant for regulatory bodies and payers as law enforcers, whose goal is the formation of legitimate standards of behavior.

Ihor Olender drew attention to the resolution of the joint chamber of the Supreme Administrative Court of Ukraine dated December 22, 2020 in case No. 260/1743/19, which details the criteria for distinguishing financial responsibility from other types of legal responsibility. It is an autonomous type of responsibility that has specific legal qualifications in accordance with national tax legislation.

According to the speaker, the PC of Ukraine still does not contain a definition of the concept of "guilt". According to the updated wording of clause 109.1 of Art. 109 of the Code of Ukraine, a tax offense is an illegal, culpable (in the cases expressly provided for by this Code) act (action or inaction) of a taxpayer (in particular, persons equated to him), controlling bodies and/or their officials (officials), other subjects objects in the cases directly provided for by the PC of Ukraine. The key difference between this definition and the definition until January 1, 2021 is the establishment of an independent new criterion for the guilty act (action or inaction) of the payer. The necessary basis for bringing a person to financial responsibility for committing a tax offense is the establishment by the controlling body in the regulated clause 109.3 of Art. 109 of the Code of Ukraine in cases of the fault of the payer, which means that the person had and can follow the rules and regulations established by the Code of Ukraine.

The judge also drew attention to the decision of the Supreme Administrative Court of the Supreme Court of December 8, 2022 in case No. 520/9294/21, which interprets the provisions of the current tax legislation, which define guilt as an objective aspect of tax offenses. Therefore, in order to establish its existence, the supervisory authority must prove that the taxpayer did not have an appropriate attitude towards his illegal actions / inaction (awareness of his actions, understanding of the consequences, etc.), that the taxpayer, by committing actions or allowing inaction for which responsibility is established, acted "unreasonably, in bad faith and without due diligence."

Given the use by the legislator between these words in Art. 112 of the PC of Ukraine the conjunction "and" ("unreasonably, in bad faith and without due diligence") it is important to prove all of the above circumstances in total, if the payer had the opportunity to behave appropriately. All these three criteria are evaluative concepts, the precise meaning of which must be determined by the results of judicial interpretation.

Establishing the boundary between the reality and fictitiousness of economic transactions, it is necessary to take into account the truncated composition of the tax offense in the context of the interpretation and application of the concept of guilt within the limits of the objective side of such a tort.

According to the speaker, in order to form clear guidelines for the behavior of law enforcers in tax law, the concept of guilt needs judicial interpretation, in particular, in the context of the functioning of payers in blackouts or, for example, the resolution of tax disputes regarding developers.

During his speech, the judge of the Supreme Court in the Cassation Administrative Court Mykola Gimon familiarized the listeners with the criteria for the admissibility of a cassation appeal against court decisions in tax disputes regarding the reality of economic transactions.

First of all, the speaker reminded that Part 4 of Art. 328 of the Civil Code of Ukraine contains the grounds established for cassational appeal of court decisions. At the same time, he noted that clauses 1-4 of this rule refer to the requirements for cassation appeals when challenging the decisions of the first and appellate instances, which resolved the dispute on the merits of the claims, and do not refer to court decisions that resolved the procedural issue, including resolutions of the appellate court, which annulled the court decision of the court of first instance and closed the proceedings in the case and/or left the claim without consideration (revocation of such decisions is provided for in Part 1 of Article 353 of the Civil Procedure Code of Ukraine).

Speaking about the mandatory conditions that must be specified in the cassation complaint in the case of its submission on the basis of part 4 of Art. 328 of the Civil Procedure Code of Ukraine, the judge noted that such a complaint must contain justification of the incorrect application by the court (courts) of the norms of substantive law and/or violation of the norms of procedural law in relation to all the conclusions of the courts of previous instances, which became the basis for satisfaction (refusal of satisfaction) of the lawsuit and reference to the relevant clause of part 4 of this article as a ground for a cassation appeal of the court decision (with the indication of the mandatory conditions in their relationship provided for the relevant ground).

In the case of filing a cassation appeal on the basis of clauses 1–3 of part 4 of Article 328 of the Civil Code of Ukraine, the legal norms indicated by the complainant, which, in his opinion, the courts applied incorrectly, should regulate the disputed legal relationship, and the question of their application was raised before the courts of previous instances within the scope of the grounds of the claim and/or objections of the parties (for example, from the point of view of their violation by the plaintiff / defendant). That is, it is unacceptable to indicate in the cassation complaint those arguments that were not the grounds of the lawsuit and/or the subject of assessment by the courts of previous instances.

It is also a mandatory condition when appealing court decisions on the basis of clauses 1 and 2 of part 4 of Art. 328 of the Civil Code of Ukraine there is a similarity of legal relations in cases (in which the opinion of the Supreme Court is stated and in which a cassation appeal is filed). At the same time, the similarity of legal relations means, in particular, the identity of the subject composition of the participants of the relations, the object and subject of legal regulation, as well as the conditions of application of legal norms (in particular, the time, place, grounds for the emergence, termination and change of the relevant legal relations). The content of legal relations in order to clarify their similarities in various decisions of the court (courts) is determined by the circumstances of each specific case. At the same time, the circumstances that shape the content of legal relations and affect the application of the norms of material law, and the evaluation of their totality by the courts cannot be considered the similarity of legal relations.

In addition, Clause 4, Part 4, Art. 328 of the Civil Code of Ukraine and Part 2 of Art. 353 of the Civil Code of Ukraine usually cannot be independent grounds for a cassation appeal of court decisions, however, the complainant is not deprived of the opportunity to define them as additional to clauses 1, 2, 3, part 4 of Art. 328 of the Civil Code of Ukraine a reason with justification in accordance with the legal content of a specific item provided for in Part 2 of Art. 353 CAS of Ukraine.

The event was organized by the National Association of Lawyers of Ukraine and the All-Ukrainian Association of Administrative Judges.